Tl;dr: Stablecoins are tokens that represent fiat money, playing a critical role in bridging between the traditional fiat world, and the crypto ecosystem. Stablecoins act as a stable, trusted medium of exchange to buy, sell, save, earn, and transfer money around the world.

What are Stablecoins?

Stablecoins are digital assets with value pegged 1-to-1 to traditional assets like the U.S. dollar, gold, or the Euro. This makes it much easier to transfer money in and out of the crypto ecosystem without having to worry about significant short-term price swings in assets like Bitcoin and Ethereum.

For example, you can trade or purchase $1000 worth of USDC with traditional U.S. dollars, and allow that to sit in your crypto wallet – knowing that exact amount will remain stable. Then, if and when you want to send money to a friend, purchase a good, or buy Bitcoin or ETH, you can do so at your convenience.

Stablecoins are a key part of the DeFi (decentralized finance) ecosystem. DeFi supports many of the activities you would do in the traditional financial ecosystem, like lending money, borrowing, getting interest on your assets and more – but without the traditional intermediaries who normally capture most of the profits.

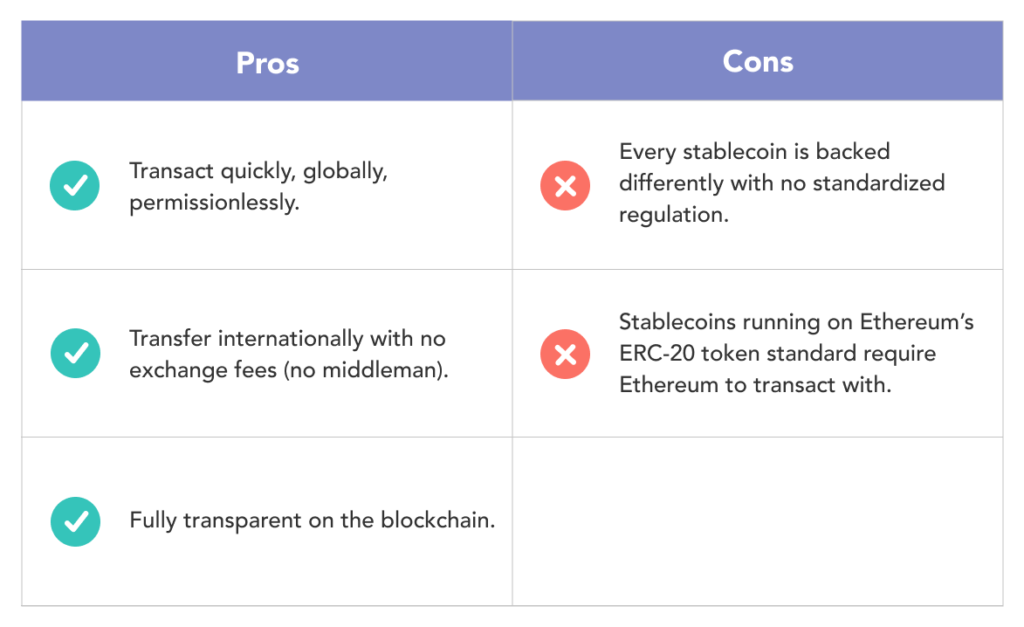

Most stablecoins are backed by traditional assets or currencies like U.S. dollars or gold. However, we are still in the early days of stablecoin regulations, so every stablecoin is managed differently. Therefore, it’s critical you do your own research to understand how and who manages the stablecoins you chose to hold. We’ve included information on most of the top stablecoins, below!

4 Ways to Use Stablecoins

Stablecoins are a key part of the DeFi (decentralized finance) ecosystem that take advantage of crypto’s global, decentralized, permissionless infrastructure.

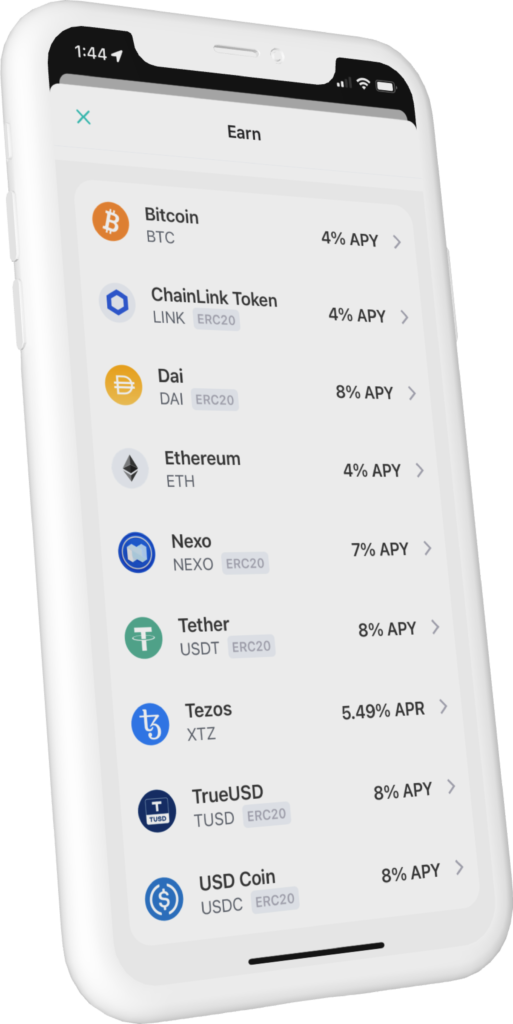

With stablecoins you can transact globally, reduce portfolio volatility, lend and borrow, and even earn yield on your crypto (up to 8% APY through Zengo Savings).

Here are 4 of the top ways stablecoins are used:

- Transact: Stablecoins can be an excellent way to send and receive money around the world, instantaneously, for (near) zero fees. Without the need to rely on a bank or money transfer service, stablecoins allow you to transfer money around the world without limits. You can also buy and sell many goods using stablecoins, enjoying the benefits of blockchain processing power without the negatives of short-term price fluctuations in cryptocurrencies like Bitcoin and Ethereum.

- Portfolio Balancing: While long-term investors might feel comfortable buying and holding Bitcoin and Ethereum – ignoring the ups-and-downs – large price fluctuations can be stressful, especially if there are plans to spend some of the money in the short-term. That’s where stablecoins come in. When cryptocurrencies dramatically rise in value in a short period of time, some investors sell some of their ETH for stablecoins to increase portfolio stability. Similarly, when cryptocurrencies like go through a downtrend, selling stablecoins to buy crypto “at a discount” can be a great way to rebalance a crypto portfolio.

- Lend and borrow: Stablecoins have also become a central part of DeFi (decentralized finance) which is essentially trying to replicate what traditional banks and financial service companies do, but in a decentralized manner on the blockchain. These days, you can borrow, lend, and even earn yield using stablecoins.

- Maintain money inside the crypto ecosystem: Instead of selling cryptocurrencies like Bitcoin or Ethereum for U.S. dollars, trading cryptoassets for stablecoins allows you to keep them inside of the crypto ecosystem, maintaining access to their value but without the need to worry about price volatility.

How do Stablecoins Work?

While Bitcoin and Ethereum are the most popular cryptocurrencies, their short-term price fluctuations make them difficult to use as a medium of exchange. Enter stablecoins! Stablecoins were created to solve two of the major issues with cryptocurrency — specifically, short-term price volatility, and the challenge of converting cryptocurrencies to fiat currency and vice versa.

The goal of a stablecoin is to achieve price stability – whether the coin is pegged to the U.S. dollar, Euro, or Korean Won, what you see is (ideally) what you get: A stable, dollar-like currency that can ride the magical rails of crypto: making it easy to send, receive, buy, sell, save, or invest instantaneously and around the world, without the need to pay fees to banks or money transfer companies.

One of the most important questions is how a stablecoin achieves price stability – how the stablecoin is collateralized, or how the coin is backed. Today, there are 3 ways to do so, each following a different approach:

- Fiat-Collateralized Stablecoins: Fiat-collateralized stablecoins maintain a centralized reserve of traditional assets like dollars and/or precious metals including gold to maintain price stability. For example, USDC maintains U.S. dollar denominated assets (which are usually a mix of actual U.S. dollars and short-term U.S. treasury bills) to maintain the 1-to-1 peg with the U.S. dollar. Other stablecoins like Tether (USDT) and True USD (TUSD) claim to do something quite similar.

- Crypto-Collateralized Stablecoins: Crypto-collateralized stablecoins are backed by other cryptocurrencies or assets locked inside of various blockchains. For example, DAI is a stablecoin pegged 1-to-1 to the U.S. dollar, backed by smart contracts locked in the Ethereum blockchain.

- Algorithmic Stablecoins: Algorithmic stablecoins don’t rely on asset reserves like U.S. dollars, precious metals or cryptoassets locked in smart contracts to maintain price stability. Instead, these types of stablecoins use an internal mechanism to regulate supply, much like the way a country’s central bank can adjust its currency based on market supply and demand. Stablecoins like the Terra ecosystem’s UST function this way in a decentralized, autonomous manner, using Terra’s LUNA token to smooth out potential short-term price fluctuations.

Examples of Stablecoins

Here are 4 of the most-used stablecoins:

Tether (USDT) was the first stablecoin ever created, and is denominated in U.S. dollars 1-to-1. Tether was created to solve two of the major issues that early adopters found with cryptocurrency — namely, the volatility of the market and the difficulty of converting cryptocurrencies to fiat currency and vice versa. Tether (USDT) is a cryptocurrency backed by an equivalent amount of U.S. dollars, making it a stablecoin. After Bitcoin and Ethereum, USDT is the third-largest cryptocurrency by market capitalization. It is used around the world by many people who need a way to transfer traditional fiat money into crypto, and vice versa.

However, unlike other stablecoins, its internal policies are not 100% clear, and there have been worries in the past that USDT is not backed 1-to-1 by the U.S. dollar as it claims to be. Learn more about USDT here. USDT is available on Zengo as an ERC-20 token.

USD Coin (USDC) is a stablecoin that tracks the U.S. dollar, and it currently runs on the Ethereum network. USD Coin was founded in response to the launch of Tether, the world’s first stablecoin. The founders wanted to create a stablecoin with even stricter, more transparent policies. USDC emulates Tether by providing a more stable and convertible cryptocurrency, but, in contrast to Tether, the company follows strict governance policies and explicit regulations for USDC creation and redemption.

USDC issuers must report their U.S. dollar holdings every month, which is published online by an accountancy firm for anyone to view. USDC operates within regulated frameworks and U.S. money transmission laws, working with established banking partners and auditors. Learn more about USDC here.

USDC is available on Zengo as an ERC-20 token.

TrueUSD (TUSD) is a stablecoin tracking the U.S. dollar built on the TrustToken platform and says it is fully-collateralized and transparently verified (clearly poking at other stablecoins, like Tether). Introduced in 2018, it aims to be a simple, reliable stablecoin without any complex algorithmic or unclear backings.

TUSD is available on Zengo as an ERC-20 token.

DAI: DAI is a decentralized stablecoin on the Ethereum blockchain that tracks the U.S. dollar and is managed by the MakerDAO community. Unlike many stablecoins which are backed directly by U.S. dollars in centralized bank accounts, DAI attempts to stabilize 1-to-1 with the U.S. dollar by locking assets into smart contracts on the Ethereum blockchain.

Zengo supports DAI as an ERC-20 token. Learn more here.

Questions to Ask before Buying and Using Stablecoins:

There are a few questions you should be asking yourself before purchasing or holding stablecoins. Here are a few of the top ones:

- What institution manages this stablecoin, and how public and trusted are the audits on its reserves?

- Where is the stablecoin regulated, if at all?

- What blockchain(s) does this stablecoin run on?

- What type of stablecoin is it, and how is it collateralized?

Look above to learn the answers for many of the ecosystem’s top stablecoins!

How to Buy Stablecoins on Zengo

- Open your Zengo crypto wallet (tap here to download Zengo)

- Tap on “Actions” on the bottom of your screen

- Tap on “Buy”

- Tap on the stablecoin you would like to purchase, including USDC, USDT, TUSD, UST, and DAI

Friendly Reminder: Many stablecoins run on Ethereum’s ERC-20 token standard. This includes USDC, USDT, TUSD and DAI. Any ERC-20 token requires Ethereum (ETH) to send or trade, so make sure to have some ETH in your Zengo wallet! This ETH gas fee is paid to the Ethereum network and not to Zengo.

Frequently Asked Questions

Q: Why do I need Ether (ETH) to trade or send ERC-20 token stablecoins from my wallet?

A: ERC-20 tokens run on the Ethereum blockchain as smart contracts. In order to execute a smart contract, the Ethereum network requires a fee (usually referred to as a “gas fee”) paid for in Ether (ETH). This fee is not paid to Zengo but rather to the Ethereum mining network for validating and executing your requested transaction.

Q: How can I learn more about stablecoins?

A: There are many great resources to learn more. Check out these articles from NerdWallet, Investopedia, and CoinDesk.