The world of DeFi (aka Decentralized Finance) is moving forward at a rapid pace. A few months ago we introduced a simple and delightful way to earn on your assets via Compound lending protocol.

Today, we add support for one of its newest additions, Compound’s governance token COMP. In this post, we get you up to speed on using and redeeming COMP in Zengo and explain all the buzz surrounding “yield farming.”

TL;DR: Starting today, you can

- Send and receive COMP tokens.

- Potentially be eligible to receive COMP tokens if you made a deposit in Zengo Savings.

- Quickly check if you’re eligible to receive COMP.

- Easily redeem those COMP tokens in Zengo, on certain conditions (read below).

Compound in Zengo: Passive earnings in DeFi

DeFi is a general term for financial applications built using smart contracts on top of blockchain protocols such as Ethereum. DeFi enables financial functionality beyond the rudimentary sending and receiving of funds. One of the more prominent protocols in the space is Compound. Compound enables anyone to supply liquidity (“deposit”) for borrowers and earn interest on their holdings. To mitigate risks, borrowers put up collateral in front of every fund borrowed. You can learn more about Compound’s inner workings in our report.

Zengo was one of Compound’s early adopters. We’ve supported this DeFi protocol for a few months now.

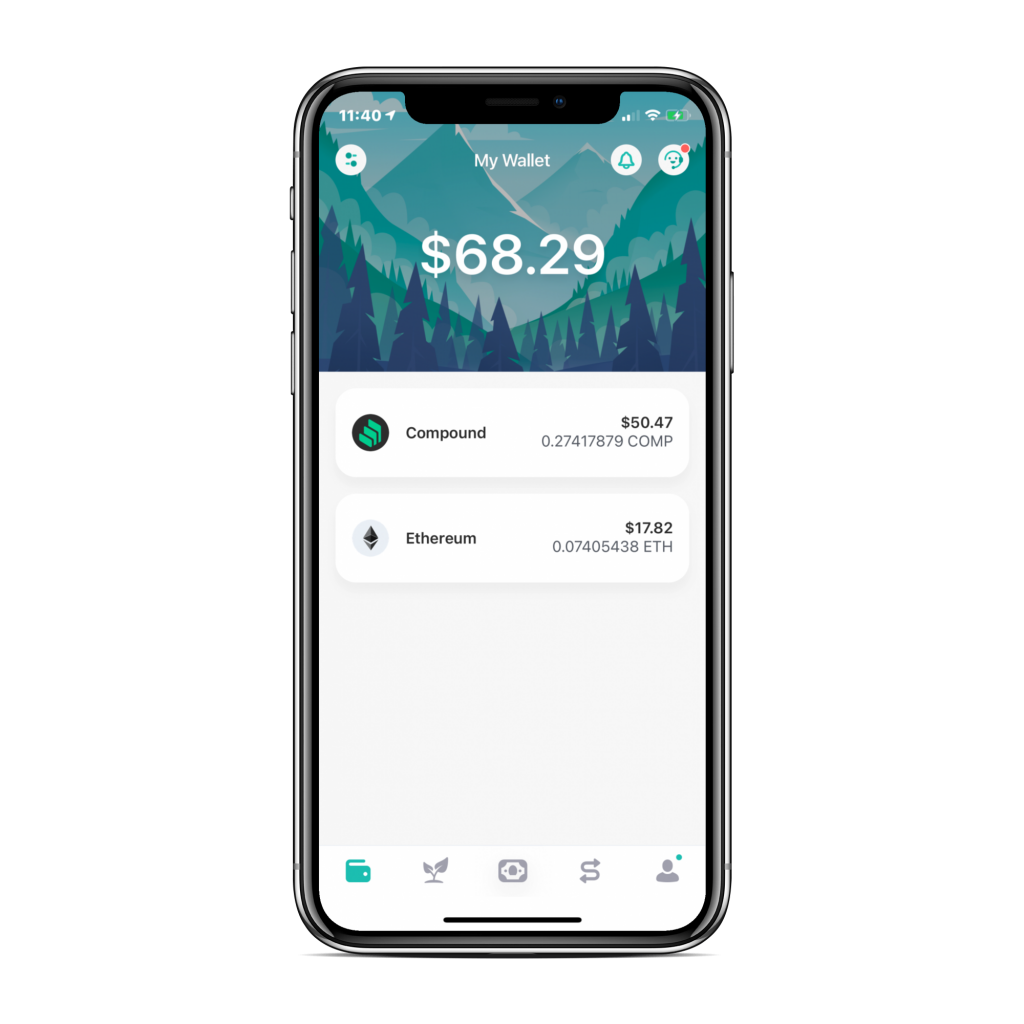

Zengo customers have been able to use Compound to passively earn interest on their crypto. But they can now also enjoy some extra earnings with Compound’s governance token COMP.

Is a COMP governance token even needed?

Initially, the compound protocol was primarily governed by its developers. Only they could make decisions such as which tokens to add to the system or which functions to upgrade in smart contracts. Like many teams, the goal was to migrate to a decentralized protocol where the community had more control.

Usually, when these kinds of statements are made, they should be taken with a grain of salt. It’s tough to turn a centralized protocol into a decentralized one, but the Compound team delivered on their promise.

Compound issued a governance token named COMP to decentralize governance. COMP is an ERC-20 token (a token on the Ethereum blockchain). Owners of COMP can create proposals to the network and vote on them. The first proposal to add USDT as a new market on Compound was created on April 27th and passed by a majority vote. At this stage, only a selected few owners of COMP could actually vote. This was the first test of the governance protocol.

On June 15th, the proposal to start the distribution of COMP to users was implemented. From that point on, COMP was listed on several exchanges, and trading began. The price of COMP shot up from an initial $60 to nearly $400 within days.

As the price spiked, it seemed like everyone wanted to know how they could get their hands on this hot new token.

How to simply get COMP in Zengo

The simplest way of obtaining the COMP token is by buying it. Like any other regular ERC20 token, COMP can be traded and bought on centralized and decentralized exchanges.

It’s also possible to get COMP by merely participating in the Compound protocol. At the time of writing, the protocol distributes 2880 COMP tokens per day assigned to users according to their relative investment.

But it’s important to understand that COMP is not transferred directly to your account. Once 0.001 COMP (or more) is accrued in a specific market (e.g., the USDC market), any action on the market will move the accrued COMP to your relevant wallet addresses used to participate in the market. This means to claim the COMP Zengo customers need to either withdraw or deposit some tokens.

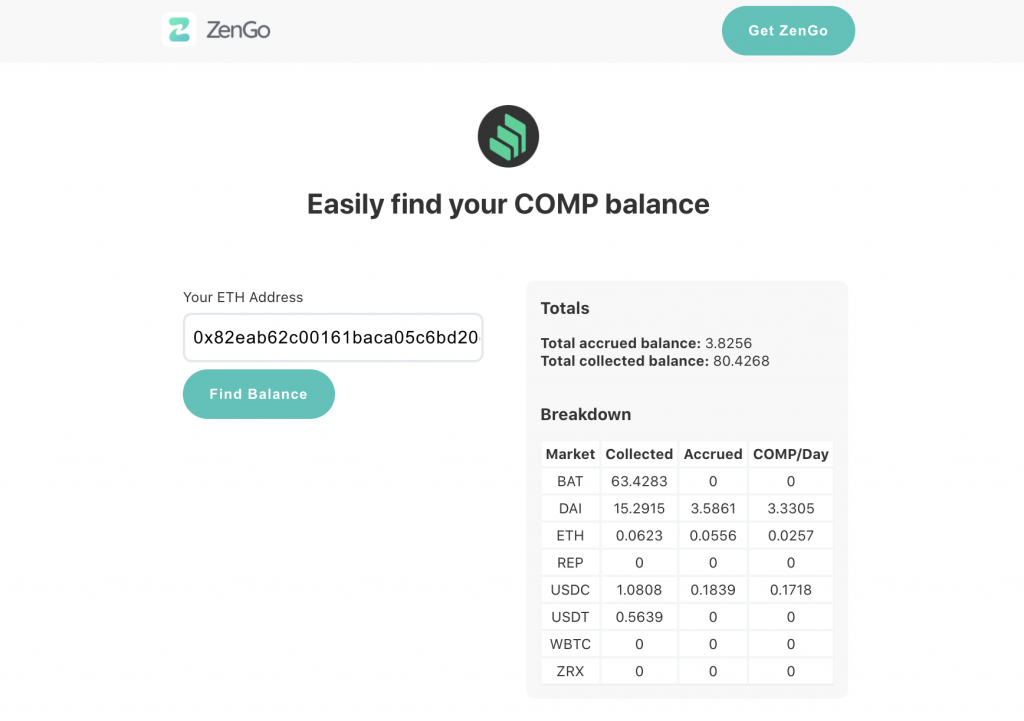

To help Zengo (and other wallet owners) find out how much COMP they have accrued, our research team has developed a tool.

Potential owners of COMP simply input their address in the tool to discover how much COMP already accrued on their behalf. Once the amount of the customer’s accrued COMP in a market passes the threshold, any action (withdrawal or deposit) in this market will automatically claim these accrued COMPs.

How to get COMP on Zengo in 5 easy steps

- Deposit a token in savings (e.g., USDC).

- Use the tool and see when the accrued COMP passes 0.001.

- Deposit or withdraw the token (e.g., USDC) where you accrued COMP.

- To view your COMP tokens activate COMP in the asset manager.

- Watch your COMP balance grow.

COMP and the “Yield Farming” craze

The distribution of COMP to users creates an interesting dynamic. Under normal circumstances, DeFi investors would not borrow a token and pay interest on it unless they have a good reason.

Getting paid to borrow is an excellent reason, and this is exactly what’s been happening over the past few weeks.

Depending on the market price of COMP, it was sometimes profitable for users to borrow tokens. The payment they received in COMP outweighed the interest rates they had to pay for borrowing.

This market phenomenon can be used for yield farming. Yield farming is basically the process of finding the best strategy by using multiple DeFi protocols to gain the most out of the funds you currently own. It’s fairly complex when seen from the outside, so it’s natural to feel a little overwhelmed at first.

For example, let’s say BAT is the most profitable token to deposit and borrow. You can deposit USDT, which earns you COMP and borrow BAT against it, which, as we mentioned, is actually profitable.

You then trade the BAT for USDT in a DeFi service (such as, for example, Uniswap) and repeat the process again. Even though you’re paying for the borrowed BAT, this can still be profitable due to accrued COMP.

Congratulations, you are now a yield farmer!

Too good to be true? Yield farming caveats

Like everything else in DeFi (and life), there is no free lunch. Yield farming can be profitable, but it’s not a “money printing machine.”

There are several factors yield farmers need to take into account:

- Fees: It doesn’t make sense to put a small amount into Compound if a trade’s expected profits don’t cover the transaction fees, which might be several USD each.

- Changes in interest rates: Depositing an asset into a market may be profitable at current interest rates. However, Compound’s interest rates are dynamic and change rapidly according to the market’s actual supply and demand. A drop in the interest rate may cause an investment to lose money.

- Changes in asset prices: It may be profitable to harvest COMP using BAT in today’s BAT price. However, this can change if there’s a drop in BAT’s price. The risk of loss is made even more severe if investors have leveraged their position, which can result in liquidation.

- Change of COMP rules: Compound rules can be changed. After all, this is the entire point of the governance token. But a rule change may turn a winning investment into a losing one, as it can change the distribution of COMP for investors.

These concerns are not theoretical. Recently, the interest rate for BAT rose to nearly 30% right after the launch of COMP. Rates have now returned to near 0%, due to a change in the COMP distribution protocol.

These factors mean yield farming is a game for vigilant professionals with enough liquidity, risk analysis capability, and the operational experience to respond quickly to market changes.

The good news is that Zengo allows its customers to enjoy the additional fruits of their original investment in Compound with no added risks.