TL;DR: Hunting for real-world incidents in blockchain data sometimes leads to interesting insights and findings. In this case, we were able to find UCSF’s $1.14M ransom payment on the blockchain and correlate it to an additional $700K transaction. This potentially increases the paid UCSF ransom to over $1.8M.

Following our recent article on the $4M Bitcoin CWT ransomware payment, we continued to hone our blockchain hunting skills. Usually, these skills are used to protect Zengo customers.

This time, however, we had a different focus. We managed to track down the $1.14M ransom paid by the University of California San Francisco (UCSF).

You might remember this case.

It gained widespread exposure because ransom negotiations between UCSF’s negotiator and hackers were made public and covered by popular media outlets like BBC and Bloomberg.

In this article, we’ll share our findings and some additional insights we were able to infer from the Bitcoin blockchain data. We’ll also describe our methods so other security researchers can explore similar incidents in the future and possibly create a safer environment for all of us.

How to find a ransomware transaction

According to the threatpost, UCSF paid a $1.14 million ransom to recover data related to academic work. This data was encrypted after the NetWalker ransomware hit the medical school at the university.

Unlike the CWT case linked to above, public reports on UCSF ransomware did not include the attackers’ Bitcoin address, supposedly preventing researchers from analyzing the money trail. This made our investigations a little more cumbersome. However, we did not give in.

As we should all know by now, Bitcoin data is pseudonymous, not anonymous. Users are represented by mostly meaningless addresses, however all transactions between these addresses can be watched by anyone. With this in mind, we knew it would be possible to find the address if we could obtain enough information on the transaction details and money trail “pattern” (more on that below).

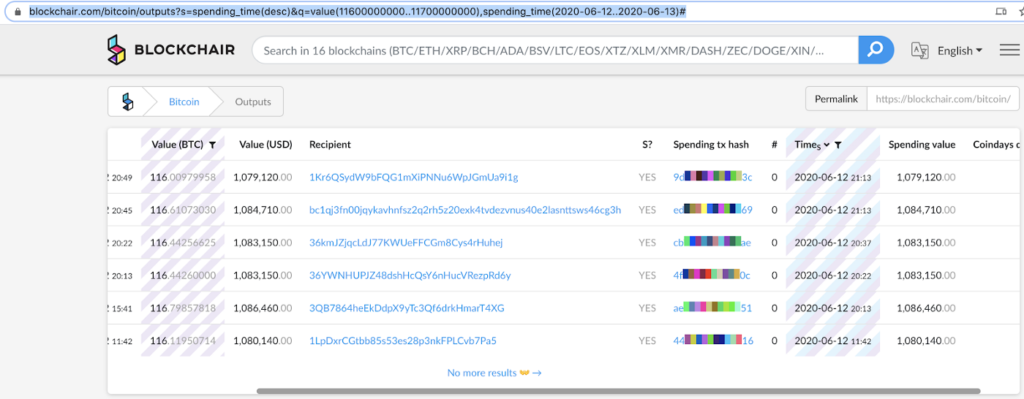

Diving into the media stories, we found two technical details that assisted in our investigation. The paid ransom sum was 116.4 BTC ($1.14M at the time), and the payment took place on the 12th of June.

While sending such a large and specific amount of money in a particular time period may seem like enough to identify the transaction, we wanted to be sure. To have an even higher level of certainty, we required the transaction to be part of the following blockchain “pattern”.

Ransomware payments usually follow a distinct pattern:

- Negotiators buy the exact amount of Bitcoin requested by attackers, from a large liquidity provider. The negotiators use a “fresh” address, with no previous history to prevent any data leakage, for this transaction.

- Negotiators then immediately transfer this full amount to the attackers’ fresh address. The transfer is done rapidly as negotiators don’t want to keep so much money in their possession for a long time. (Sometimes, negotiators will send a small transaction first to make sure they have the right address and then send the full amount.)

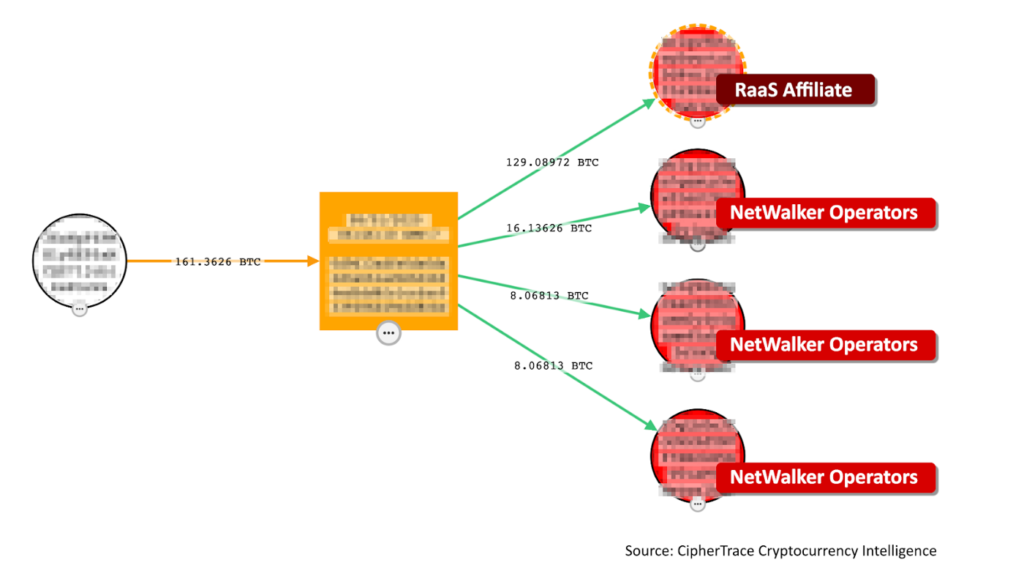

- Once the payout lands in the attackers’ initial address, the attackers split the loot. In the case of the NetWalker ransomware, this split is very distinct. The NetWalker gang worked in a “Ransomware-as-a-service” (RaaS) model. The gang operates the infrastructure, while the affiliate drives the operation and infects the victim. Thanks to ciphertrace research, we know that this model creates a “four arms” pattern, depicted below. The NetWalker gang operators get 20% of the loot, split into 10%, 5%, and 5% payments to known addresses. The remaining 80% goes to the RaaS affiliate.

Finding the transaction

Using BlockChair’s interface, we could query the Bitcoin blockchain for transactions on the date and the reported sum. We provided a slightly bigger range for both dates and sums to allow some flexibility in case the details in the story were not exact. We created a query to retrieve transactions where the sum is between 116 and 117 Bitcoin, and the date is between the 12th and 13th of June:

Results returned six possible candidates, but it was easy to identify the relevant ransom transaction, as it followed our assumptions detailed above.

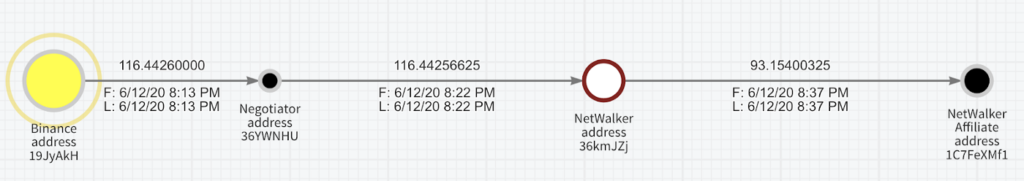

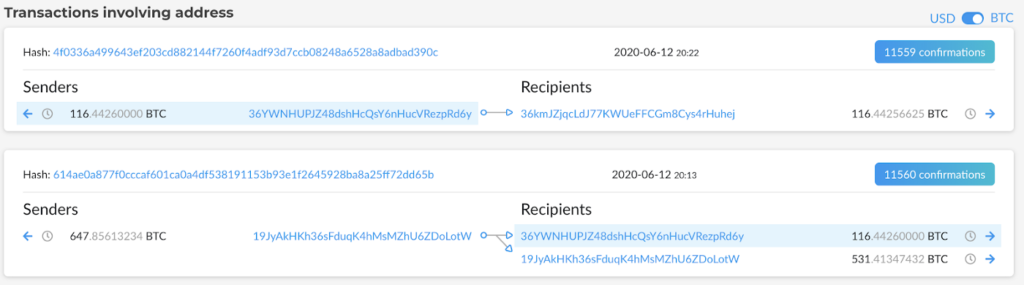

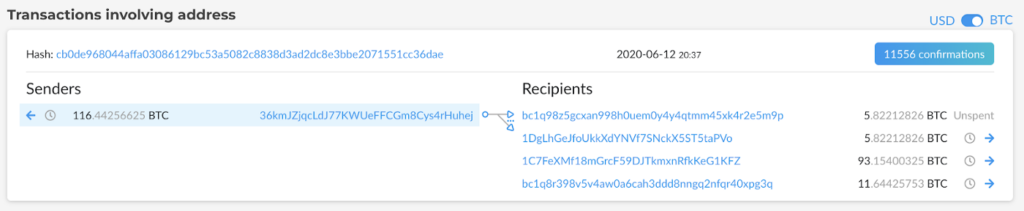

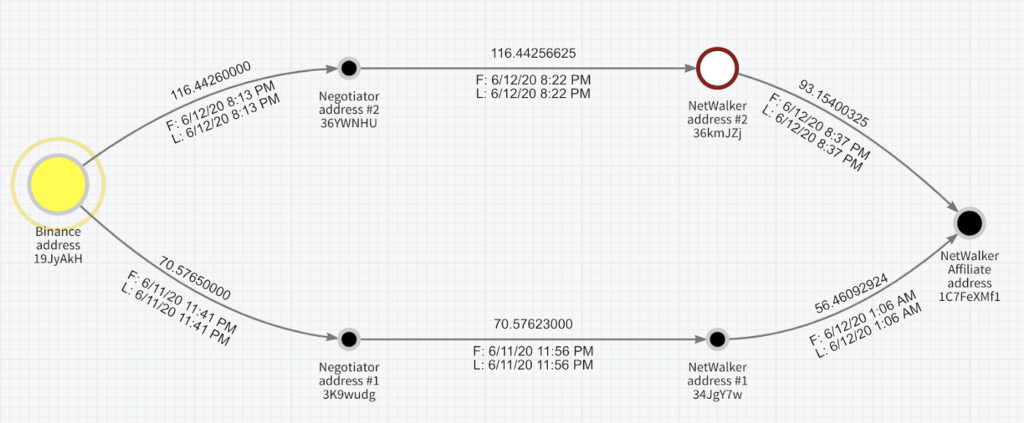

As we had expected, we found the Negotiators (address 36YWNH, shortened for readability) buying 116.4 BTC from Binance exchange (address 19JyAkHKh, associated with Binance according to Clank) into a fresh address on the 12th of June at 20:13 (All times UTC), then paying immediately to a fresh NetWalker address (address 36kmJZj).

The NetWalker address immediately split the ransom money, sending 20% to the known NetWalker address in the usual split (5%, 5%,10%) and 80% to the NetWalker affiliate (address 1C7FeXMf1).

The additional “four arms” transaction

We discovered the ransom money trail, and verified the media story by cross-checking it with Bitcoin blockchain data.

However, we weren’t done yet.

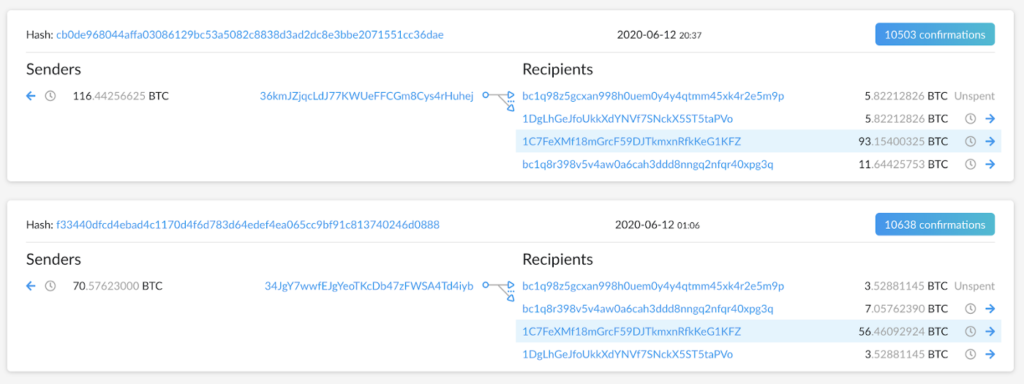

We discovered a similar “four arms” payment to the same affiliate address, made only 19 hours before the UCSF payment.

Oddly enough, the money trail followed a similar path from the same Binance address to the same NetWalker affiliate. The Negotiators bought 70.5 BTC (about $700K) from the same provider (Binance, address 19JyAkHKh) and put it into a fresh address on the 11th of June at 23:41. They then transferred it immediately to a fresh NetWalker address, that was split to the same NetWalker affiliate (address 1C7FeXMf1).

This extra payment to the same attacker could be related to the UCSF incident or another unrelated ransomware incident. However, after talking to ransom negotiation experts, the former option is much more likely. This puts the total ransom paid by UCSF to the attackers closer to $2M (187 BTC, or $187K at the time).

According to these experts, in many cases, payments are not paid at once but tranched in return for certain “milestones” to build rapport between parties—for example, one payment to delete exfiltrated information or get more information on the penetration method used by attackers and a second to receive a decryption key.

Having the same liquidity provider (Binance), the same negotiator wallet “technology” (type of address and other technical optional fields) together with the payment to the same affiliate, which was conducted only 19 hours before the UCSF payment provides a strong, albeit circumstantial, support to this theory too. .

Additionally, the alternative explanation, that connects the first payment to another unrelated ransomware incident by the same NetWalker affiliate happening in parallel is unlikely. These two ransom transactions are the only NetWalker “four arms” transactions for this NetWalker affiliate. It doesn’t seem likely this NetWalker affiliate would have conducted two independent ransomware campaigns in parallel with the same address, and then completely disappeared.

Summing up

“Big game hunting” ransomware incidents targeting large enterprises are all over the financial news. However, in many cases, the details are often left in the shadows, as both attackers and victims want to keep the incidents from public view. Using Bitcoin blockchain research can help fill this information gap and reveal vital information on ransomware incidents.

At Zengo, our customers’ security is our top priority. That’s why we try to learn from every crypto-related security incident. In our experience, we’ve found that observing incidents is always useful and often leads to some interesting insights. We believe understanding this incident may increase the awareness of law enforcement and help them detect and stop such underworld payments in the future.